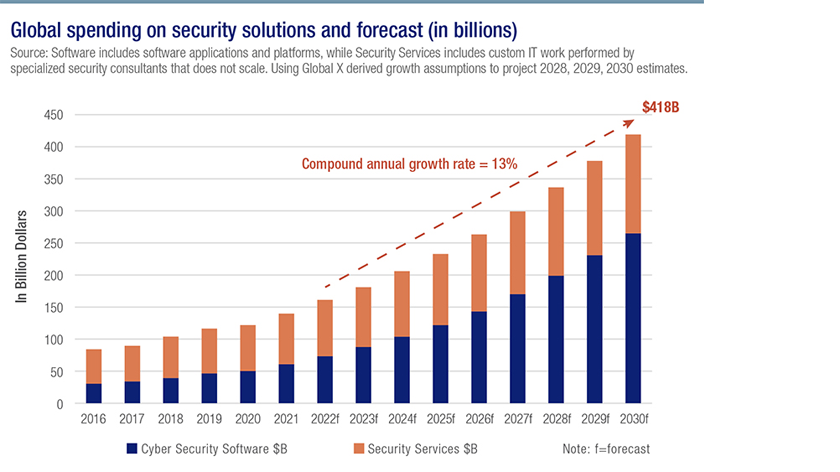

Corporations will likely respond by increasing cybersecurity spending. In addition to corporate demand, government demand is also shaping up to be a strong catalyst. The combination of corporate and government spending on cybersecurity provides a strong tailwind, supporting companies in this industry.

Moreover, most cybersecurity companies employ a subscription business model known as software as a service (SaaS). This model provides a recurring revenue stream, increasing predictability and resilience to these businesses. It also translates into lower overall costs and improved customer relationship stickiness. Some of the fastest growing cybersecurity vendors have high net retention rates relative to the broader enterprise software cohort, highlighting the incremental value existing customers continue derive from these services.2

Preparing for the future

Security challenges continue to receive heightened scrutiny from policy makers, business leaders, and consumers. And, since digital threats show little correlation to macroeconomic conditions, cybersecurity spending retains recession-resistant characteristics.

Meanwhile, digitization continues to expand the digital surface area companies must defend, providing positive fundamental support for cyber companies’ growth outlooks.

Ascent Private Capital Management of U.S. Bank provides Investment Management, Investment Consulting, and Investment Monitoring for clients with complicated investment scenarios. Learn more.