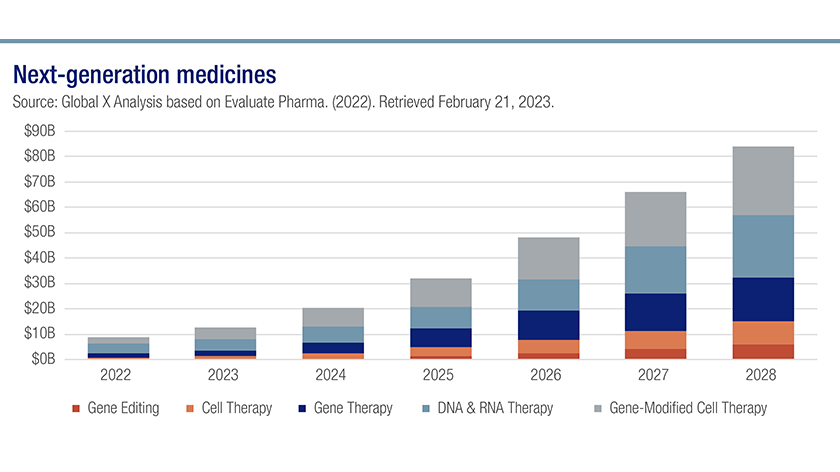

Analysts anticipate strong clinical trial data and continued unmet medical need across a host of illnesses will drive significant sales growth in next-generation genomic medicines from $8.8 billion in 2022 to $84 billion in 2028.5

A spotlight on genomic sequencing

The biotech company Illumina estimates that the genomic sequencing market will exceed $120 billion by 2027.6 Illumina estimates the sequencing industry is currently only 7% penetrated but it expects penetration to grow to 14% by 2027.7 Academic organizations, government institutions and pharmaceutical firms are among early research adopters, utilizing genomic sequencing to drive drug discovery and pathogen monitoring.

Industry observers anticipate continued declines in human genome’s sequencing cost will expand genomic technology adoption from research to clinical applications. Clinical firms use genomic sequencing to offer unique insights into individual patients’ genomes, informing patient care options and improving patient outcomes. Industry firms have worked to drive the cost per genome sequence down from nearly $100 million in 2002 to approximately $600.8 Firms anticipate the cost-per-genome sequence will further decline to $100, increasing availability and adoption of genomic analysis and unlocking genomics’ broader potential. To date, analysts estimate only 0.07% of the world’s population has had their genome sequenced.9

As the practice becomes more widespread and more data is collected, a virtuous cycle could emerge. Since vast amounts of data are needed for a comprehensive study of the human genome, a greater sample size should enable scientists to more accurately verify and validate new insights, which could improve treatments, thereby encouraging more people to have their genomes sequenced.

Widespread genomic sequencing adoption opens the door to a host of diagnostic and therapeutic applications. In cancer, genomic sequencing is helping deliver cost-effective, non-invasive screening options. Liquid biopsies are tests that look for medical signs to a specific illness in a patient’s blood. This approach can be particularly beneficial for detecting cancers that currently do not have proven screening methods and thus require invasive tissue biopsies. Liquid biopsy tests can be used as a routine screen for the presence of cancer-derived biomarkers, which analysts forecast a market opportunity exceeding $30 billion.10 Liquid biopsy tests, via genomic analysis, could also help drive therapy selection, helping predict a patient’s drug response and monitor for cancer cell recurrence. Analysts estimate drug response and cancer cell monitoring markets will grow to $6 billion and $15 billion, respectively.11,12

Preparing for the future

Continued evolution in genomics and precision medicine has the potential to fundamentally change healthcare knowledge and delivery. Human biology’s rapid convergence with big data, advanced analytics and scalable computing power offers unprecedented insights into how diseases of all kinds afflict humankind and, even more importantly, how they may be prevented. From the use of new therapies to altering our own DNA, genomics’ far-reaching potential to transform healthcare forms a compelling thematic investing opportunity.

Ascent Private Capital Management of U.S. Bank provides Investment Management, Investment Consulting, and Investment Monitoring for clients with complicated investment scenarios. Learn more.