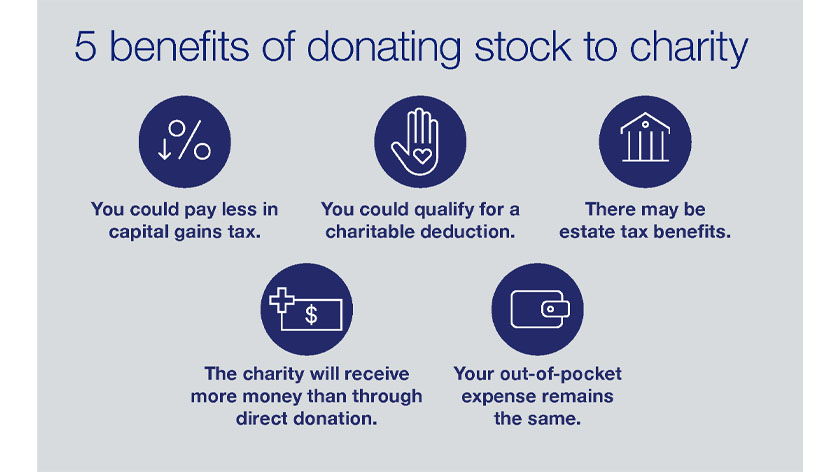

“In essence, you’re increasing the charitable impact of your donation, because the charity will receive the full value of the appreciated stock, not the value of the stock less capital gains taxes,” says Stapleton. “The strategy may be especially beneficial during years when your income is high, and you want to lower it in order to decrease your tax burden.”

How does a gift of equity work?

Before you incorporate gifting stock into your tax and philanthropic strategy, consider these equity compensation guidelines:

- You must have held the equity compensation for at least one year to realize any tax benefits. If you’ve held it for less than one year, you can only deduct the cost basis of the stock. In other words, you can only deduct its fair market value at vesting or on the date you make the contribution, whichever is lower. To help compensate for this, you can use the deduction to offset up to 50% of your AGI.

- Choosing to donate highly appreciated stock offers greater tax advantages than donating stock with smaller gains. This is because the charitable deduction and capital gains tax savings are larger. This also provides the charity with an asset that has the potential to grow and generate a more significant return over time.

How to gift stock: Types of equity compensation

Equity compensation awards take several different forms, including:

- Nonqualified stock options (NSOs)

- Incentive stock options (ISOs)

- Restricted stock units (RSUs)

- Restricted stock awards (RSAs)

The awards themselves cannot be donated to charity, notes Stapleton. Instead, they must be exercised or vested and the proceeds donated to charity. “If the award isn’t vested, you don’t own it and you can’t donate it,” he explains.

Some of types of equity compensation awards are better suited to charitable donations than others. The most ideal awards for charitable donations tend to be vested RSUs and RSAs that you’ve held for at least one year after vesting, and exercised NSOs that you’ve held for at least one year after exercise.

You can also use stock received upon ISO exercise that you’ve held for at least one year after exercise and at least two years after grant, and vested RSUs and RSAs. However, there are fewer tax benefits and there may be potential alternative minimum tax (AMT) implications.

As noted above, you generally can’t transfer unvested RSUs and unexercised ISOs and NSOs to charities.

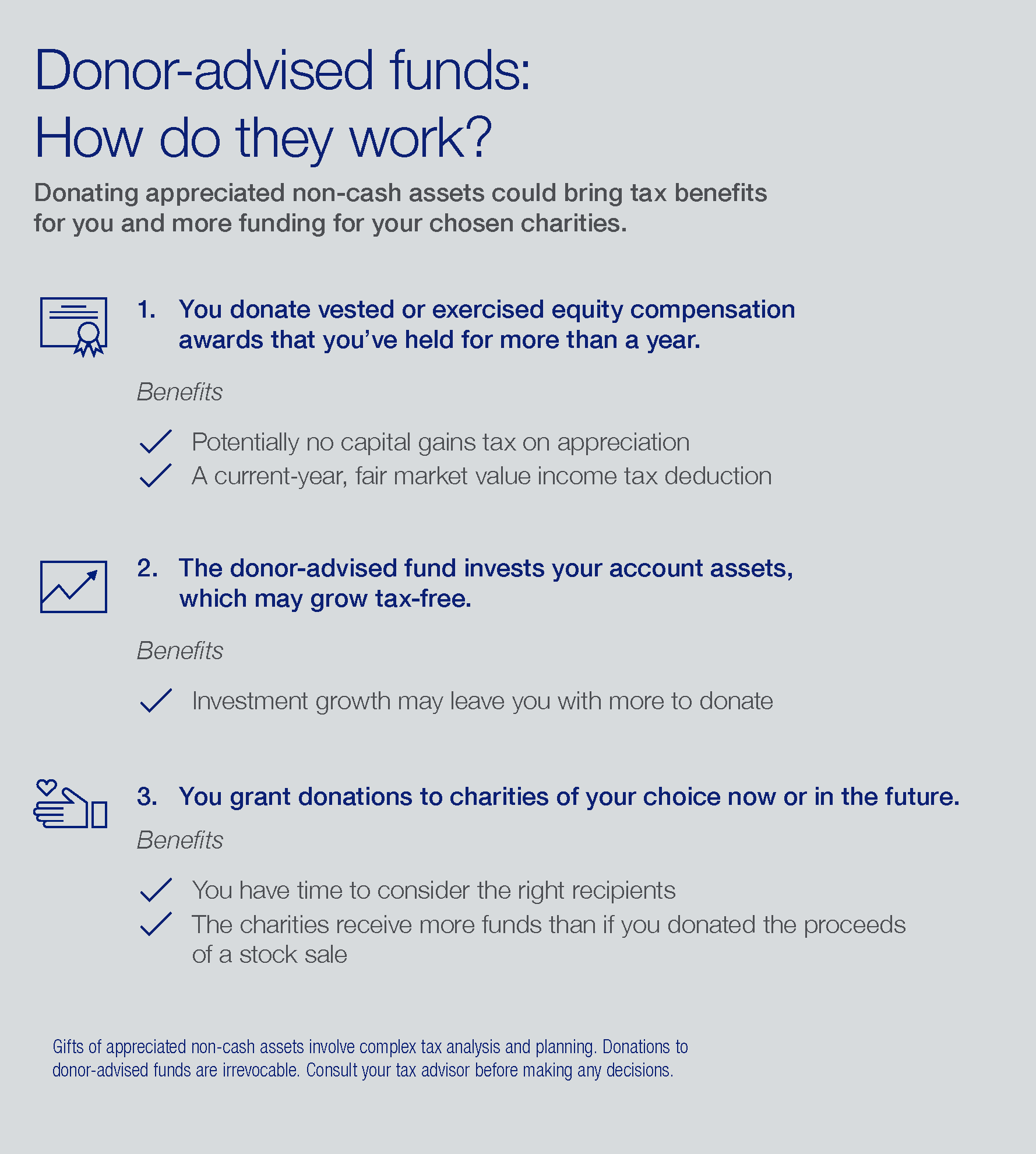

Donating equity compensation to a donor-advised fund

Rather than donating equity compensation directly to charity, a better option might be to donate it to a donor advised fund (DAF). A DAF is a qualified public charity with the resources and experience to evaluate, process and liquidate donated equity compensation, thus streamlining and facilitating the donation process.

According to Stapleton, DAFs are an easy, tax-efficient way to initiate a large charitable donation. One of the biggest benefits is that you can decide later which charity or charities will receive your donation.

“Donors don’t always know which charities they want to support when they make their donations,” Stapleton explains. “With a DAF, you receive an immediate charitable deduction for your donation and can then recommend grants to specific charities in future years if you choose.”