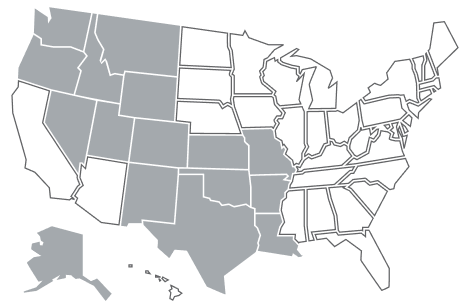

About our regional office

Each of our clients define success in different ways and have unique goals that drive them. Our Pacific Northwest/Rocky Mountain Region team works with successful families like yours to identify your distinctive needs, goals and passions, and align around a vision for the future. Then we put the full expertise of our multidisciplinary team of experts behind you to work toward your objectives. As your family’s needs evolve, so will our partnership. We’re built to serve you now and for decades to come.

Meet our Ascent regional team.

Jason Burkey-Skye

Regional Managing Director

Ray Berry

Director, Private Banking

Kim Chang

Director, Private Banking

Charles Denson

Managing Director, Private Banking

Rob Erickson

Managing Director, Wealth Strategy

Blaine Esbin

Managing Director, Client Experience

James Magarelli

Managing Director, Investment Consulting

Jack McCready

Associate Director, Investment Consulting

Robin Murray

Director, Private Banking

Eric Rizza

Managing Director, Investment Consulting

Valerie Terrill

Director, Wealth Strategy

Jonathan Tomono

Director, CFO Services

Services to amplify your impact

From investment management to family office services, from trust and estate services to private banking, we have the expertise and resources you need. Everything we do, from our deeply personal approach to utilizing advanced technology, unlocks new possibilities to generate the greatest impact.

Insights from our experts

Market news

Stay informed with our up-to-date reports on economic events and news from the markets.

Considerations for family legacy planning

These steps can help you create a legacy plan that both reflects your values and incorporates tax-efficient ways to transfer your assets.

How to become a philanthropist

Progressing from a “checkbook” donor to a philanthropist can be one of the most rewarding privileges of wealth.