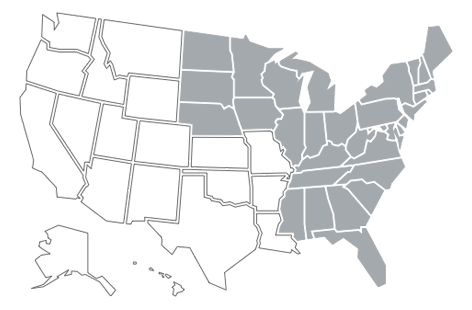

About our regional office

Each of our clients define success in different ways and have unique goals that drive them. Our Midwest/Eastern Region team works with successful families like yours to identify your distinctive needs, goals and passions, and align around a vision for the future. Then we put the full expertise of our multidisciplinary team of experts behind you to work toward your objectives. As your family’s needs evolve, so will our partnership. We’re built to serve you now and for decades to come.

Meet our Ascent regional team.

Ben Ollendick

Regional Managing Director

Charlene Altman

Managing Director, Client Advisory

Patrick Ellefson

Director, Investment Consulting

Justin Felicetta

Managing Director, Investment Consulting

Cortney Tessier Filipek

Director, Client Experience

Dawn Gregory

Director, Private Banking

Peter Hatinen

Managing Director, Wealth Strategy

Joe Hinderer

Managing Director, Investment Consulting

Nick Houge

Managing Director, Investment Consulting

Michele Kowles

Associate Director, Client Experience

Brian Landon

Associate Director, Wealth Strategy

Jim Linnett

Managing Director, Client Advisory

Rick Loch

Managing Director, Private Banking

Mark Moeller

Managing Director, Investment Consulting

Corey Phippen

Director, Client Advisory

Bryan Polley

Managing Director, Client Advisory

Tim Towle

Managing Director, Wealth Strategy

Jackson Ronnei

Associate Director, Client Advisory

Kayla Viola

Associate Director, Private Banking

Services to amplify your impact

From investment management to family office services, from trust and estate services to private banking, we have the expertise and resources you need. Everything we do, from our deeply personal approach to utilizing advanced technology, unlocks new possibilities to generate the greatest impact.

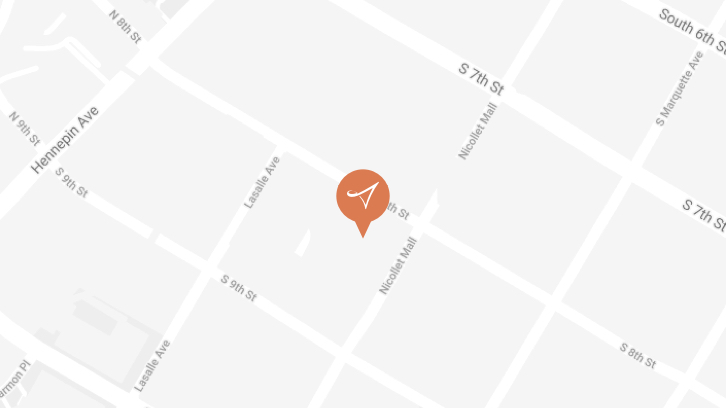

Minneapolis office location

The Ascent team is here to help families like yours sustain wealth across generations and support the people and causes you care about. We look forward to speaking with you about your financial and family legacy goals.

If you don’t see an Ascent office near you please request a call. One of our private capital management professionals would be pleased to assist you.

800 Nicollet Mall, 24th Floor

Minneapolis, MN 55402

Insights from our experts

Market news

Stay informed with our up-to-date reports on economic events and news from the markets.

Considerations for family legacy planning

These steps can help you create a legacy plan that both reflects your values and incorporates tax-efficient ways to transfer your assets.

How to become a philanthropist

Progressing from a “checkbook” donor to a philanthropist can be one of the most rewarding privileges of wealth.