In families with more than one child, it’s possible to have one who is appreciative and another who feels entitled, says Thiegs. “You see this with families that increase their access to resources over time,” he says. “They might not have an abundance of resources when they had their first child. That child grew up in an environment of scarcity, and they are more likely to have a mindset that you have to work hard and wait for things.”

As the family gets more disposable income, they may start to spend more freely. “That youngest child might develop entitlement because their experience is that things come easily,” says Thiegs. “They didn't see the budgeting process and the waiting for big purchases.”

How to develop an appreciative money mindset in children

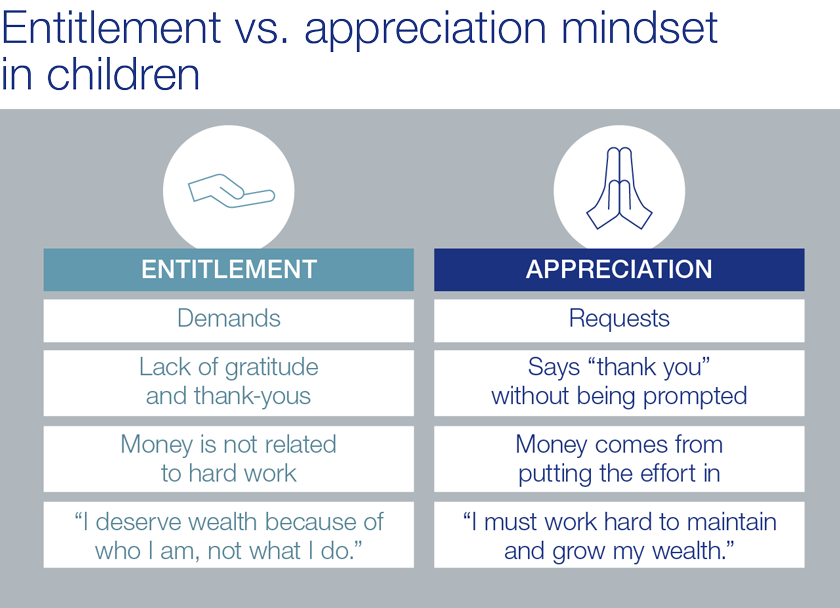

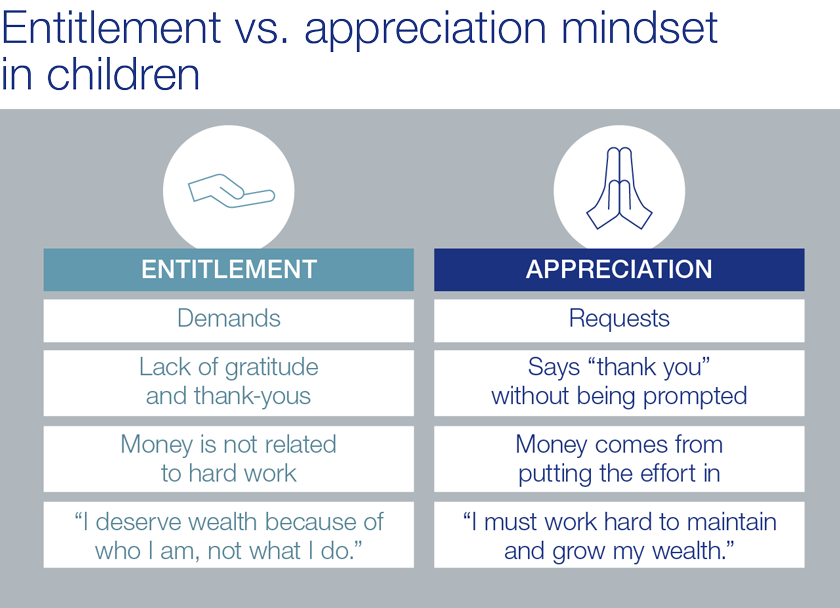

If your child has an entitlement mindset, the good news is that you can correct the situation. Entitlement stunts emotional growth, so making changes is essential, says Thiegs.

“You’ll often see toddler-like behaviors in entitled teenagers and young adults,” he says. “You might notice tantrums when they don’t get what they want. An entitled young adult is going to have a much harder time adjusting to the realities of the broader world, which will cause them some additional challenges.”

The most powerful thing a parent can do is to model appreciative behavior with actions and words. Here are some ideas.

- Connect purchases to the work that made them possible. For example, Thiegs suggests saying, “We're going on this nice vacation together. You may not realize that it took a lot of hours at work and sacrifices made on other things to generate the money that we're using to be able to do this.”

- Instill appreciation through family activities, such as volunteering together, giving to charities that reflect the family’s values, or having children help around the house with chores. “Show that helping others gives an even greater benefit than focusing just on yourself,” says Thiegs. “You also instill a good work ethic.”

- Do regular entitlement checks, as an appreciative child can become entitled later. “Think about the norms that you've created in the household,” says Thiegs. “Maybe your kids get something every time they go to the store with mom or dad. Or maybe they get an allowance that isn’t connected to their contribution to the household. Is the environment you created for your kids aiming towards creating entitlements or appreciation?”

Parenting is hard, and the goal is to create a loving environment that avoids the entitlement trap while striking a balance between expectation and reward.

“Entitlement is often the result of a loving parent wanting to make sure their child is happy,” says Thiegs. “However, that approach is focused only on the short term. Often, the intention is taking away the pain the child is experiencing, because then they'll be happy.

“Instead, parents should shift their mindset to long-term happiness. What's best for the child in the long term can have a significant and positive impact on their life.”

Learn how Ascent Private Capital Management works closely with families to lay the groundwork for a successful transition of wealth.